Investing in real estate has always been a reliable way to build wealth, but not everyone can afford to buy property. Real Estate Investment Trusts (REITs) offer a simpler alternative. With REITs, you can invest in real estate just like buying stocks, making it accessible without the challenges of property management.

Investing in real estate has always been a reliable way to build wealth, but not everyone can afford to buy property. Real Estate Investment Trusts (REITs) offer a simpler alternative. With REITs, you can invest in real estate just like buying stocks, making it accessible without the challenges of property management.

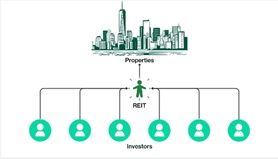

What Exactly Are REITs?

REITs are companies that own, operate, or finance income-generating properties such as shopping malls, office buildings, hospitals, and more. As an investor, you can buy shares in these companies and earn a portion of the income generated from the properties they manage.

Types of REITs

Equity REITs: These REITs own and manage properties, earning income primarily from renting out space.

Mortgage REITs: Instead of owning properties, these REITs provide financing for real estate by buying or originating mortgages. They make money from the interest on these loans.

Hybrid REITs: These combine both equity and mortgage REIT strategies, offering a mix of property ownership and financing.

Why Consider Investing in REITs?

Accessibility: REITs allow you to invest in real estate without needing large amounts of capital. You can start by buying shares in the stock market.

Diversification: Adding REITs to your investment portfolio can spread risk and provide a balance between different asset types.

Income Potential: REITs are known for paying regular dividends, offering a steady income stream.

How to Get Started

You can begin investing in REITs by purchasing shares directly through a stock exchange, or by investing in REIT-focused mutual funds or ETFs for broader exposure. It’s essential to diversify and keep realistic expectations about returns, considering the potential impact of market conditions.

Common Mistakes to Avoid

Ignoring Fees: High fees can reduce your profits, especially in REIT funds. Opt for lower-cost options when possible.

Overlooking Market Conditions: The real estate market can be volatile, so keep an eye on economic trends that might affect your investment.

Not Doing Enough Research: All REITs are not created equal. Focus on those with solid management and a strong performance history.

Take the Next Step

REITs offer a straightforward way to invest in real estate, providing both income and growth opportunities without the need for significant capital or hands-on property management.

Looking to finance your next real estate investment? Seaport Credit Canada provides the best financial solutions to help you purchase property with ease. Secure your future with us.