Investing in real estate is one of the most solid ways to build wealth over time. However, to succeed in this field, it is crucial to understand how to measure and evaluate the performance of your investments. A fundamental metric in this process is Return on Investment (ROI), which provides you with a clear insight into the profitability of your property over time. In this article, we will explore what ROI is in the context of real estate investments and how to calculate it effectively.

What is ROI in Real Estate Properties?

ROI is a financial measure that compares the gain or loss generated by an investment in relation to the initial cost of that investment. In the case of real estate properties, ROI helps you determine how efficiently you are using your capital to generate income and profits through the property.

How to Calculate ROI in Real Estate Properties

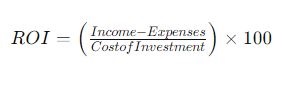

Calculating ROI in real estate properties involves taking into account both the income and expenses associated with the property. Here is the basic formula for calculating ROI:

Step 1: Calculate Income

Income from a property can come from various sources, such as monthly rent, parking income, laundry income, etc. It is important to consider all potential income generated by the property over a specified period, whether monthly or annually.

Step 2: Calculate Expenses

Expenses associated with a property include maintenance costs, property taxes, insurance, management fees (if applicable), utilities, and any other expenses related to the property. It is essential to be thorough in identifying and calculating all expenses involved.

Step 3: Calculate Cost of Investment

The cost of investment includes all costs associated with acquiring the property, such as purchase price, closing costs, repair and renovation costs, and any other initial expenses necessary to get the property up and running.

Step 4: Apply the ROI Formula

Once you have identified and calculated the income, expenses, and cost of investment, simply plug these values into the ROI formula and perform the calculations to get the final result. Multiplying the result by 100% converts the result into a percentage, making it easier to compare and interpret.

Interpreting the ROI Result

A positive ROI indicates that the property is generating profits, while a negative ROI means you are losing money on that investment. The higher the ROI, the greater the profitability of your investment. However, it is important to remember that ROI is not the only metric to consider when evaluating a real estate investment. You should also take into account other factors such as the potential for property appreciation, net cash flow, and risks associated with the investment.

By understanding how to calculate and interpret ROI, you can make more informed decisions and maximize the return on your real estate investments over time.

Investing in real estate can lead to great success when you have the right support. Trust Seaport Credit Canada to unlock the full potential of your investments and achieve your financial goals with confidence.